It’s Not What You Earn. It’s What You Keep

By Gavin Lamb, Director, Navigate Advisors

When most people talk about investing, they focus on the big numbers. “We earned a 10% return last year.” “The portfolio is up 8%.”

It sounds impressive. But there is one question that matters more than any other.

How much of that do you actually get to keep?

Because what really matters is not the headline return. It is the after-tax return. The amount that ends up in your account. The part that pays your mortgage, supports your lifestyle, and moves you closer to the life you want.

For many Australians, especially business owners and professionals, understanding this concept will completely shift how you build and even more importantly, protect wealth.

Same Investment, Different Result

Imagine you have $100,000 to invest.

Option one: you invest it in your personal name. You earn $10,000. But if your marginal tax rate is 47%, you pay $4,700 in tax. That leaves you $5,300 in your pocket.

Option two: you invest the same $100,000 inside your super. You still earn $10,000. But investment earnings in super are taxed at only 15%. So, you pay $1,500 in tax and keep $8,500.

Same return. Different structures. You are $3,200 better off in option two.

This is why the structure matters. That is why we focus not just on returns, but on the results that actually help you build wealth.

The Trap of the Big Number

It is easy to get caught chasing higher returns. But a bigger number on paper does not always lead to better outcomes. We have seen people take on more risk, invest in complicated products, or buy property in the wrong structure without realising the tax consequences. They work harder and end up with less.

You can do the opposite. You can earn slightly less, structure it smarter, and come out ahead.

What’s more amazing is that you can take less risk if you aim to earn slightly less; your structure pays less tax and you walk away with more. Imagine that; less risk, less tax and more return!

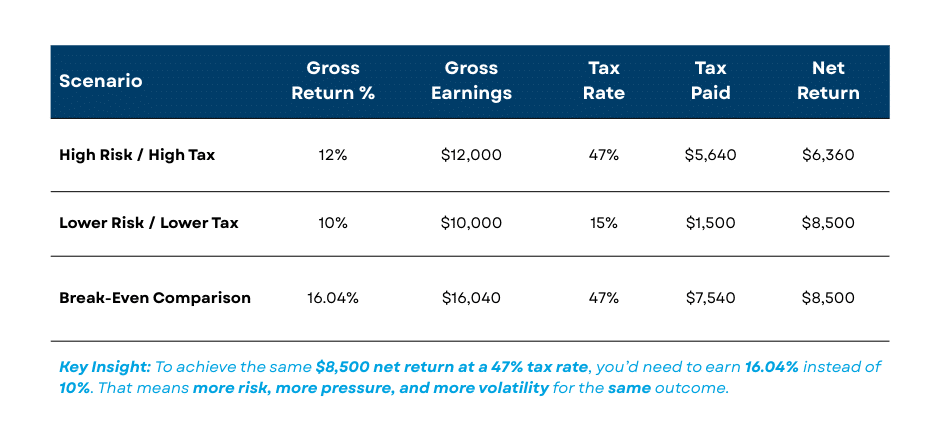

Imagine earning 12% in your investment and paying 47% tax. You’d net $6,360 assuming the same $100,000 investment in the above example.

If you earned 10% and paid 15% tax, you’d net $8,500……less risk, less tax and more return!

You’d need to earn 16.04% at a 47% tax rate to get the same $8,500 net return. That’s going to take a lot more risk to achieve.

This is the power of good strategy. It is not about beating the market. It is about keeping more of what you earn.

Investment Return Comparison (Based on $100,000):

Why This Matters to You

Keep more and use it to create freedom, flexibility, and confidence. It’s that simple.

We work with people who are serious about building a life that matters. People who have worked hard to create success and now want to make it count. That means making every financial decision work harder.

For some, that might mean using super more effectively. For others, it could be reviewing how assets and income are structured across different entities. Often, it is about simplifying what has become complicated and getting everything aligned with your goals.

The goal is always the same. To help you keep more. Use it well. And get closer to the life you want.

It Has to Be About More Than Just Numbers

We believe everyone deserves a fulfilling life. For us, that means more than just financial performance. It means knowing that your money is working as hard as you are. That every decision is part of a bigger picture. That you are not just making progress but making progress in the right direction.

This is what we do. Not just tax returns. Not just investments. Real strategy. Real outcomes. And REAL confidence.

If you are wondering whether your current structure is right for you, or if there is a smarter way to make your money work, we would love to talk.

Because at the end of the day, it is not about what you earn. It is about what you keep and what you do with it that really counts.

Clarity starts with a conversation, get in touch to book a call; https://navigateadvisors.com.au/contact/